Are you a Canadian thinking of buying US properties?

It’s exciting, but it can also feel overwhelming. The US real estate market is full of opportunities, but some unique challenges can cost you a lot if you are not careful. To help you get started on your US real estate investing journey, here are three essential things you need to consider before investing in US real estate: your tax setup, how you plan to structure your investment, and how you’ll bring your profits back to Canada.

Tax Structure: How to Avoid Double Taxation

One of the first things you’ll need to figure out when investing in US real estate is your tax structure. Many American investors use a Limited Liability Company (LLC) because it offers some advantages, like liability protection and tax benefits. But here’s the catch: this setup does not work the same way for Canadians.

The Canada Revenue Agency (CRA) doesn’t recognize LLCs the same way the IRS does, which can lead to something called double taxation. This essentially means you could end up paying taxes twice—once to the IRS and again to the CRA—without getting any credit for the taxes you’ve already paid. This double dip into your pocket can really reduce your profits from your real estate investments.

So, what should you do?

Instead of going the LLC route, consider using a Limited Partnership (LP). The CRA recognizes LPs, so you’ll be able to claim tax credits for the taxes you have already paid in the US. This way, you won’t get hit with double taxation, and you can still take advantage of the tax benefits that come with investing in US real estate, like depreciation and cost segregation.

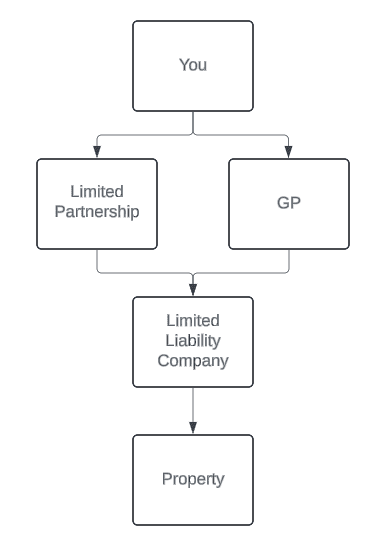

An example is (but not limited to this setup):

Personal Investment Strategy: Going Solo or Using a Corporation?

The next big decision is how you want to structure your investment. Are you planning to invest as an individual, or would it make more sense to create a corporation or another entity?

Investing as an individual might seem simpler and more straightforward, but it could leave you with more personal liability and possibly higher taxes. On the other hand, setting up a corporation or entity could offer you better protection and some tax benefits. Plus, if you plan to buy multiple properties, having a corporation can make managing them a lot easier.

What is the right investment strategy for me?

Your choice here really depends on your financial situation, your long-term goals, and how much risk you are comfortable with. That is why working with an accountant who knows the ins and outs of cross-border investments is important when you start investing in US real estate. That said, professionals who already have a background in cross-border real estate investing can help you figure out the best way to structure your investment based on your specific needs.

Repatriation of Profits: Bringing Your Money Back to Canada

Finally, let’s talk about repatriating your profits—basically, bringing the money you make from investing in US real estate back to Canada. How you handle this can have a significant impact on how much tax you end up paying.

When you earn profits from investing in US real estate, whether it’s rental income or money from selling a property, you have to decide if you are going to keep that money in the USA or bring it back to Canada. This means that each option comes with different tax implications. As an example, if you keep your profits in the US, you might be able to defer paying Canadian taxes depending on how your investments are set up. But if you are planning to bring that money back to Canada, you need to think about the most tax-efficient way to do it.

One option is to have a Canadian corporation receive the profits, which could offer better tax treatment than if you just brought the money over personally. Another strategy is to reinvest those profits in other US-based assets, like a Real Estate Investment Trust (REIT) or through a 1031 Exchange, both of which offer some nice tax advantages.

What is a REIT?

A Real Estate Investment Trust (REIT) is like a company that owns, operates, or finances income-generating real estate, such as shopping malls, apartments, or office buildings. When you invest in a REIT, you are buying shares of this company, so you own a small piece of those properties. It is a way to invest in US real estate without having to buy or manage the properties yourself.

What is a 1031 Exchange?

On the other hand, a 1031 Exchange or a like-kind exchange is a powerful tax-deferment strategy often used by experienced real estate investors. It allows real estate investors to avoid paying capital gains taxes by swapping one investment property for another if IRS rules are met. These strategies are some of the ways you can use to defer taxes or to reduce them a little bit as a Canadian investing in US real estate.

Work with Professionals

Investing in US real estate offers exciting opportunities for Canadian investors but also requires careful planning. As a future investor, you will have to research the complexities of cross-border taxation, investment structures, and fund repatriation. Understanding these three factors allows you to maximize your investment returns while minimizing tax liabilities. Learn more about how to start investing in US properties by reading the 3 wholesaling US real estate strategies for Canadians.

Remember, the key to investing in US real estate lies in working with experienced professionals who understand the intricacies of cross-border real estate investments. Additionally, an accountant and expert real estate investor who specializes in cross-border real estate investing can save you significant time, money, and stress by ensuring that your investment is structured correctly from the start. Most importantly, they will be able to help you navigate the complexities of the U.S. and Canadian tax systems, ensuring that your investments are both profitable and compliant. With their assistance, you can invest with confidence and peace of mind.

Start Your Investing Journey

Are you interested in real estate investing? Are you struggling with the high barriers to entry to the Canadian real estate market? Join us now and see how we can help you acquire your first US real estate deal in the next 45 days!

Fill out the application form below and take the first step towards expanding your investment portfolio across the border.